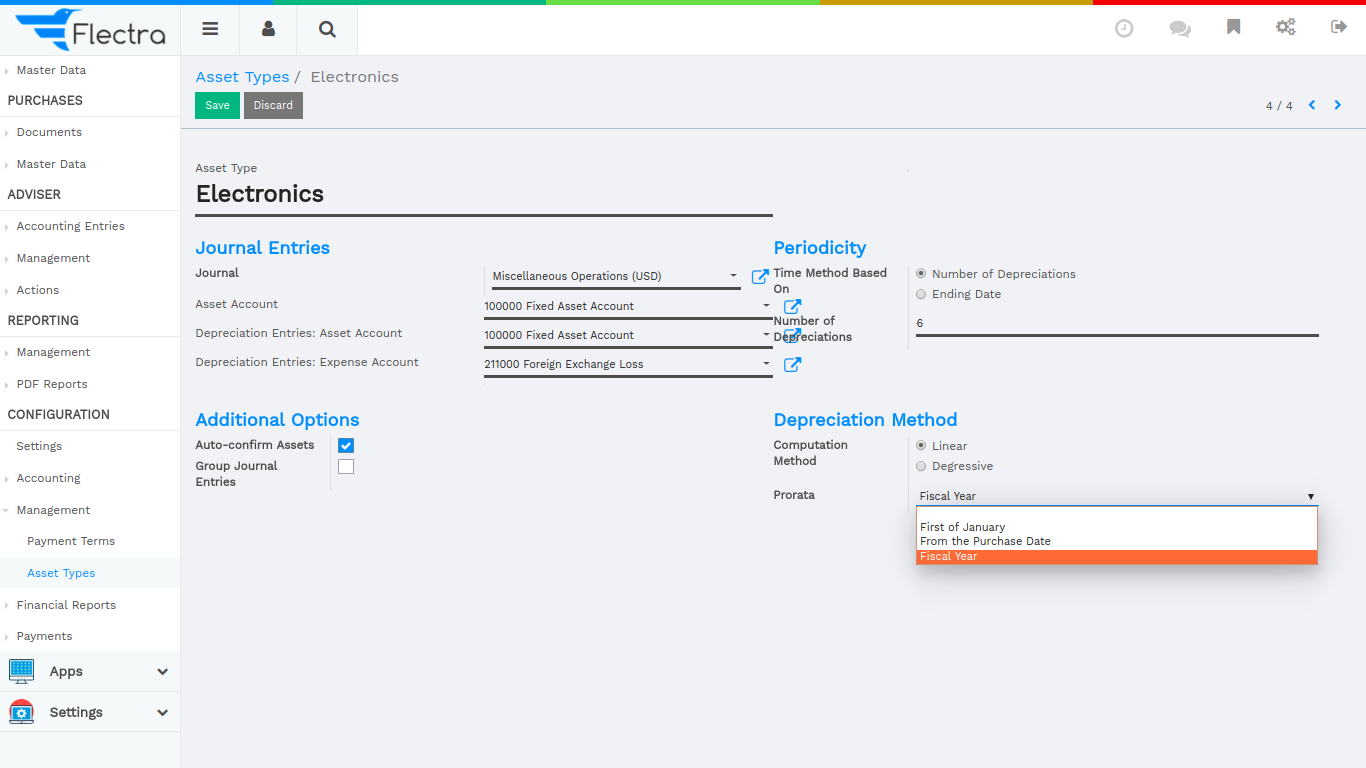

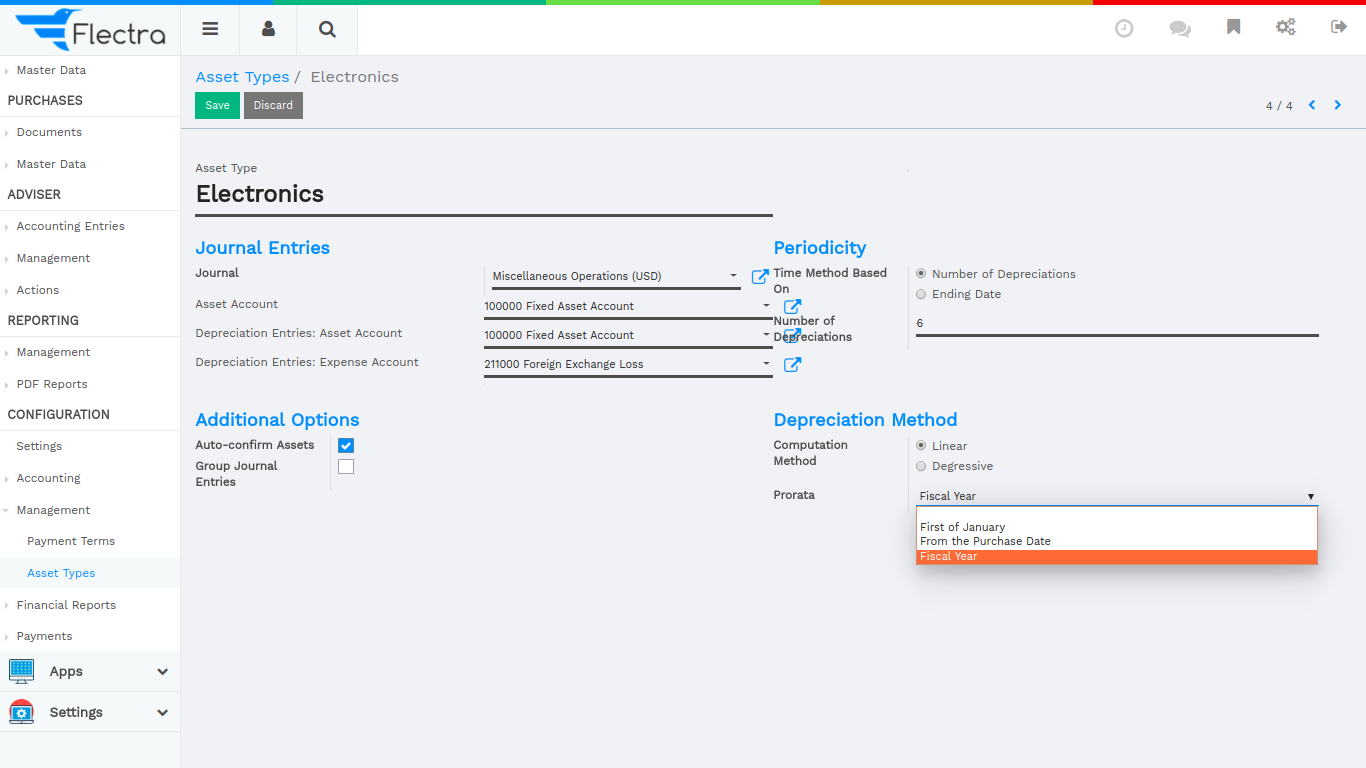

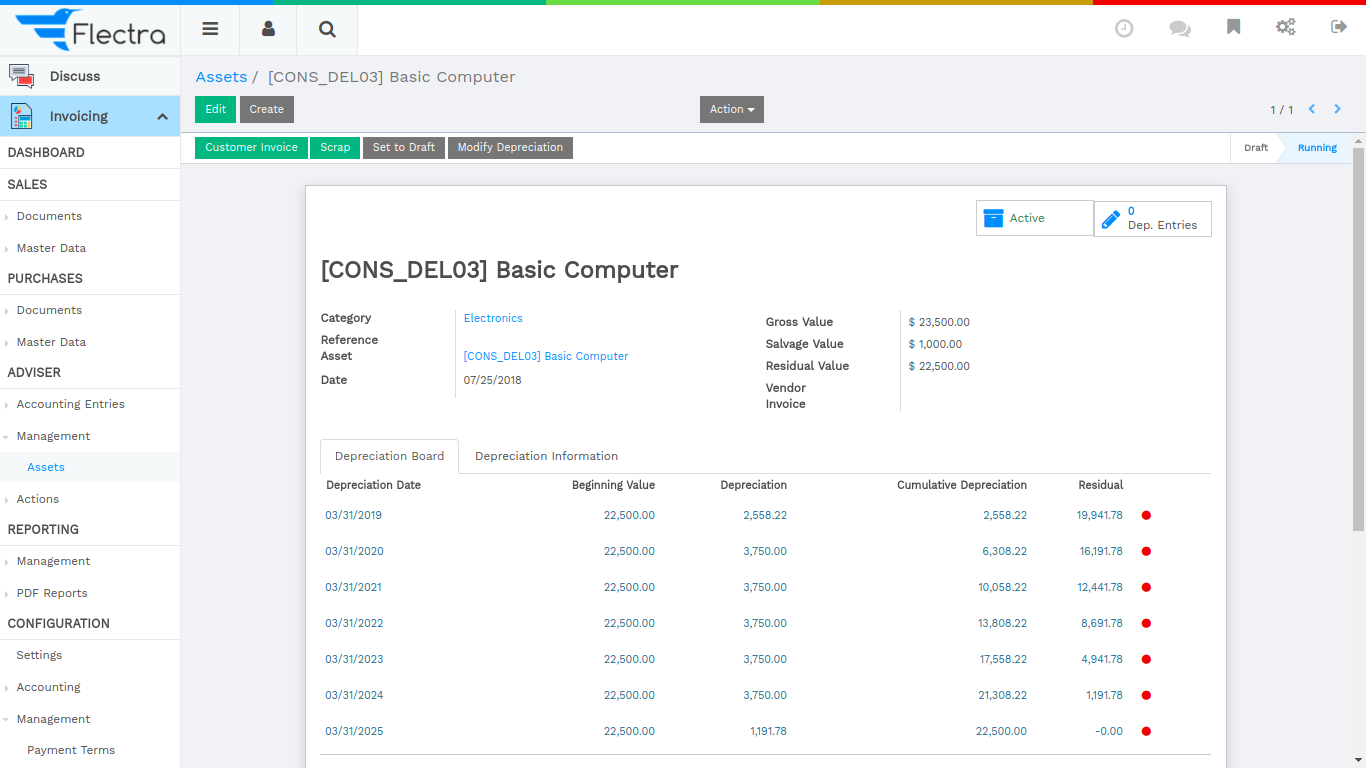

Asset Type Configuration

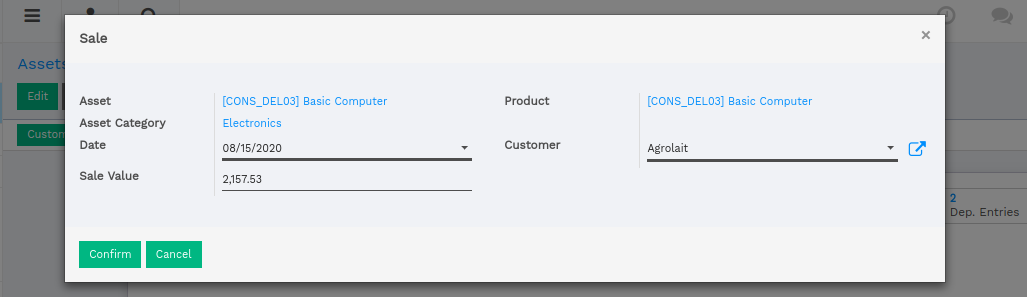

We can sale asset directly to particular customer.

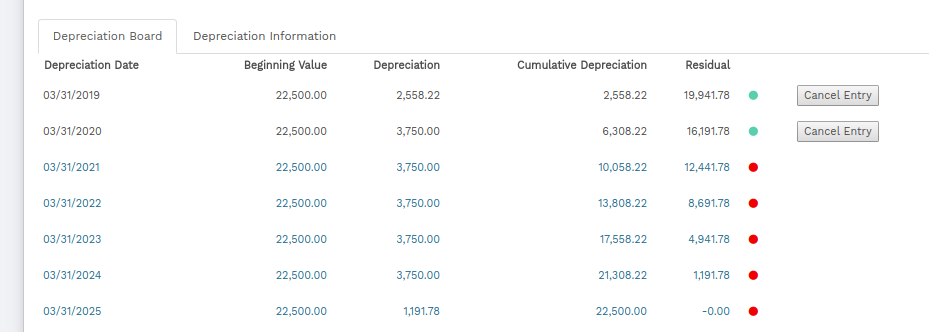

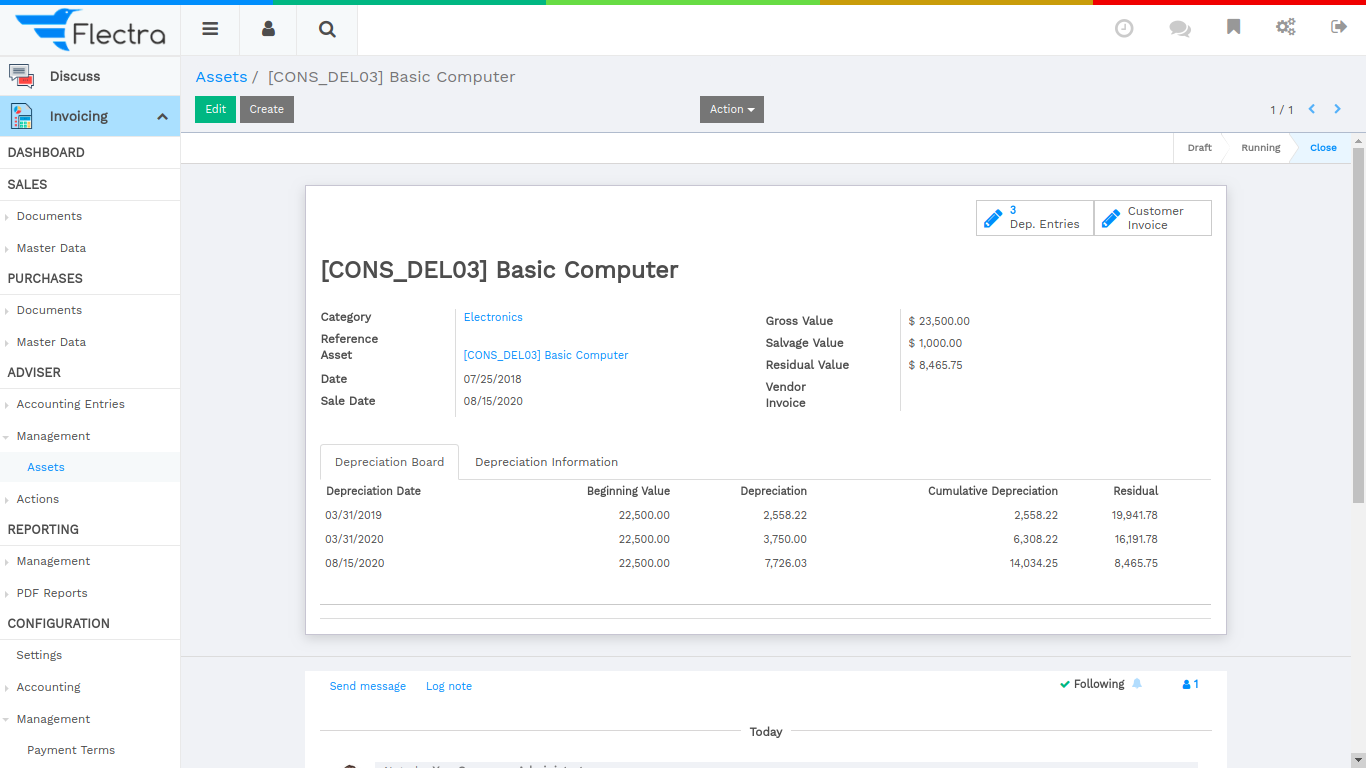

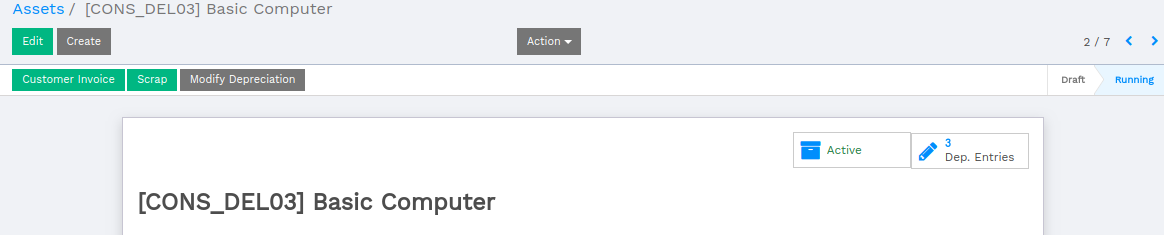

Here remove other depreciations line which is greater than Sale Date. You can also view Customer Invoice button.

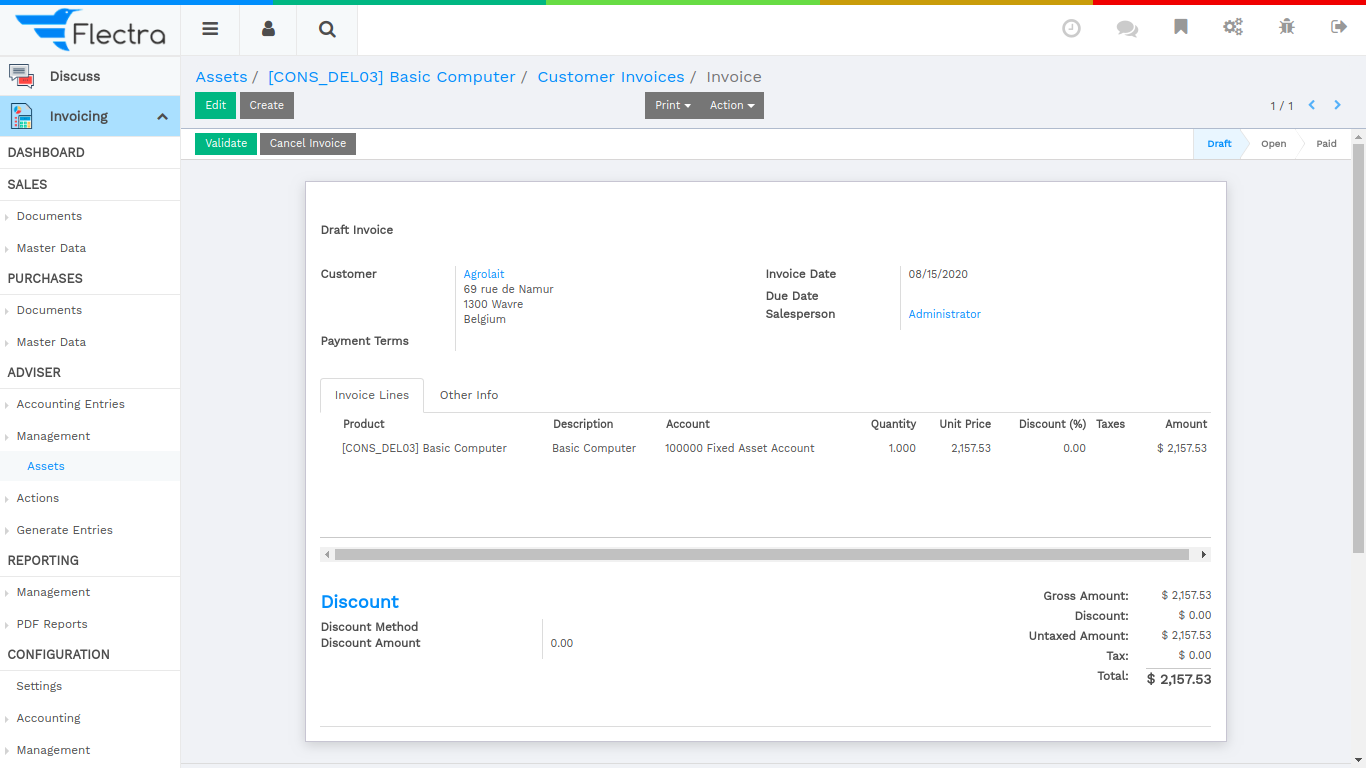

Customer Invoice details. If you created asset by Vendor Bills then it display Vendor Invoice button in asset form.

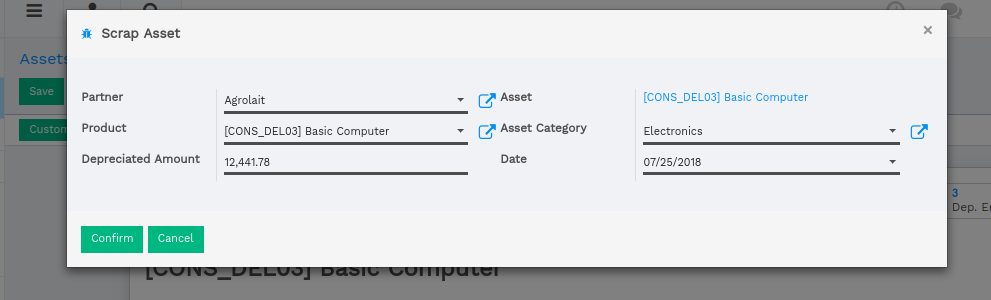

If your products that are damaged or that are unusable then you can use Scrap.

Just define the details related to Scrap Product. Once product is scrap it become Inactive.

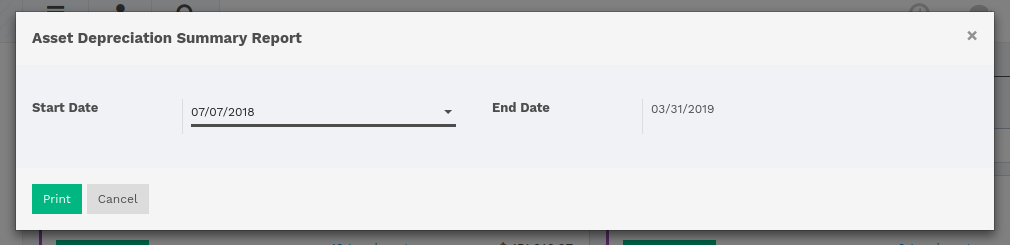

You can print report for Start Date to End Date.