Asset Categories Configuration

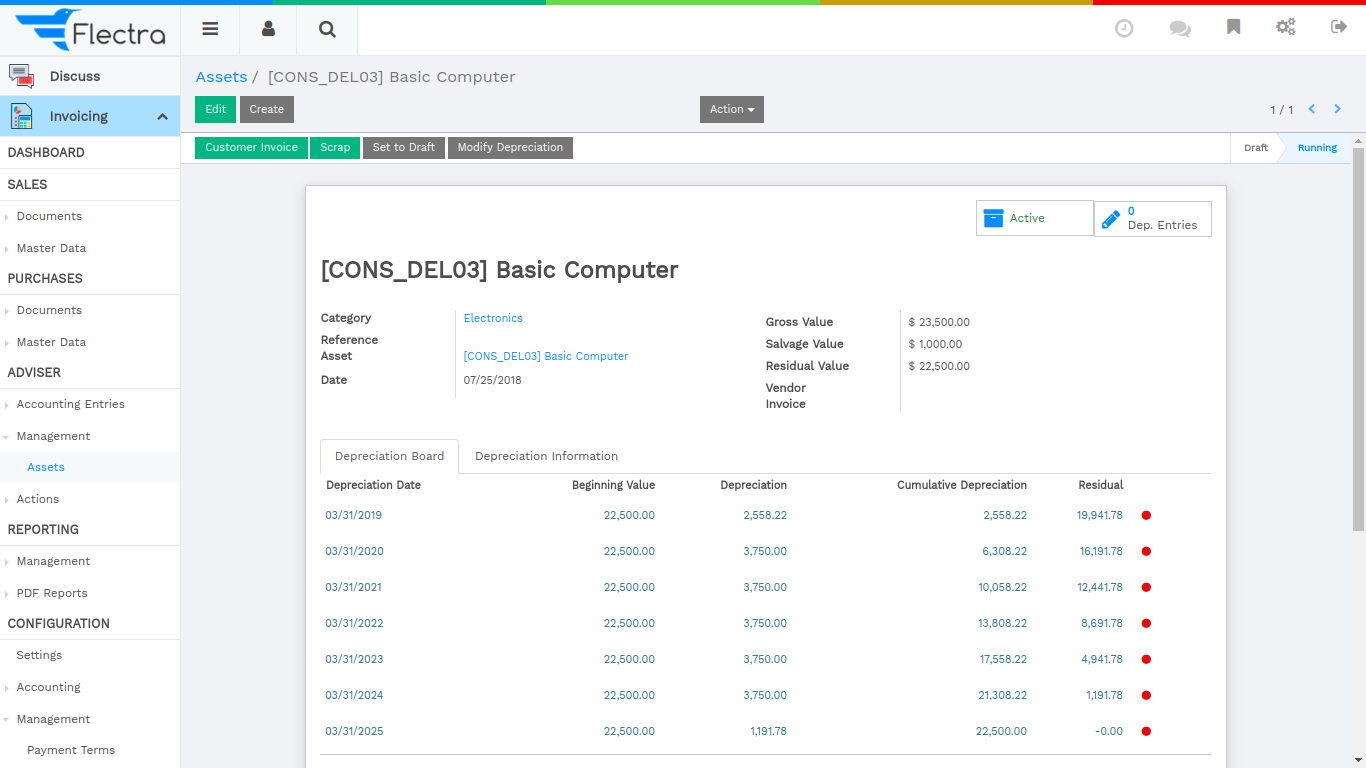

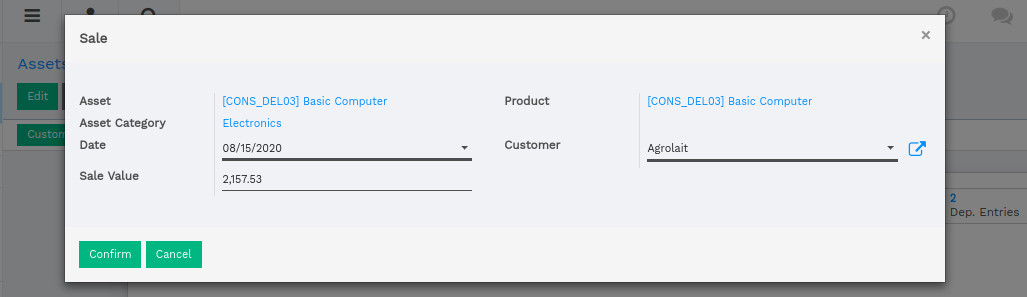

We can sale asset directly to particular customer.

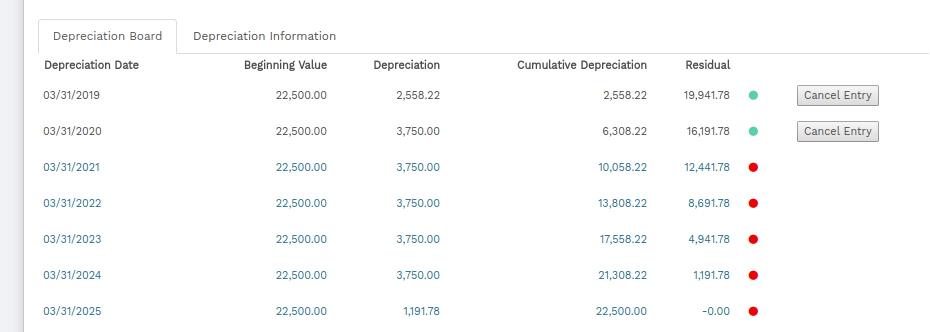

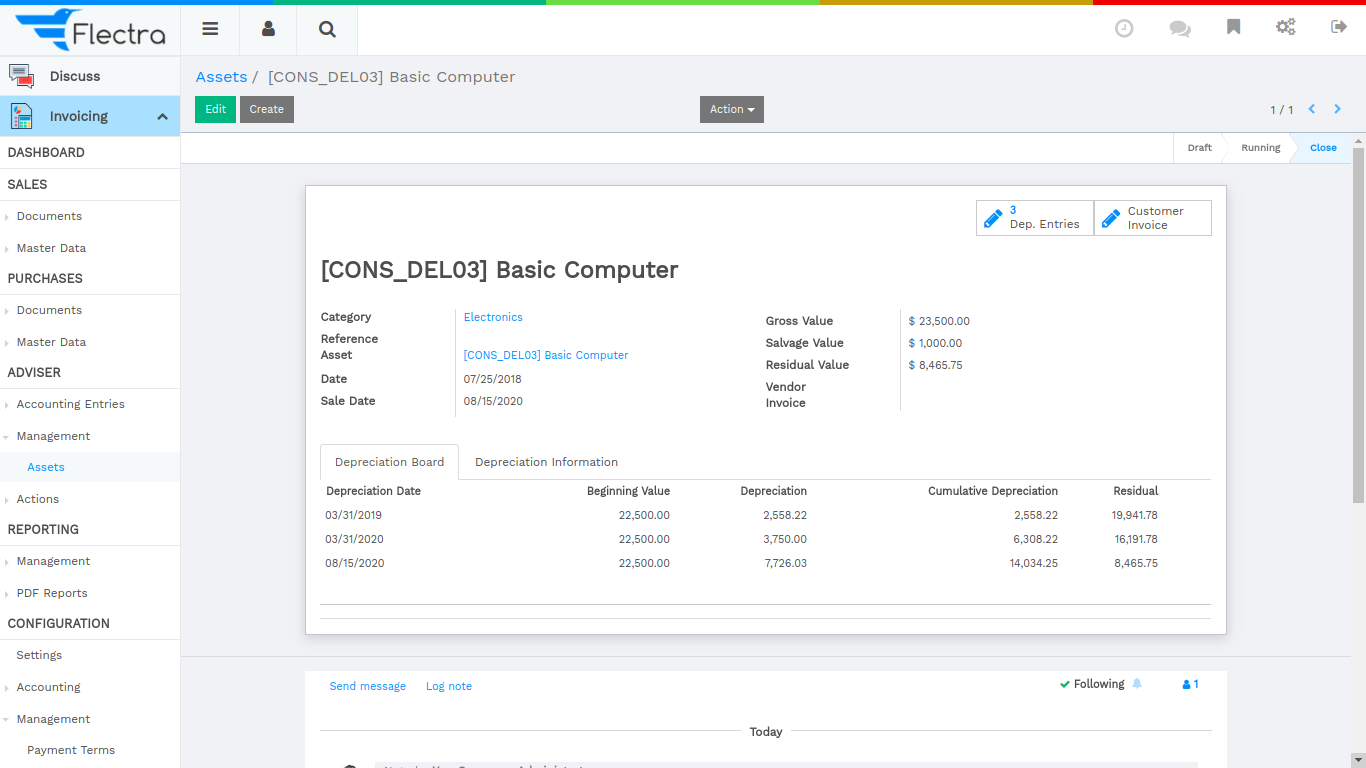

Here remove other depreciations line which is greater than Sale Date. You can also view Customer Invoice button.

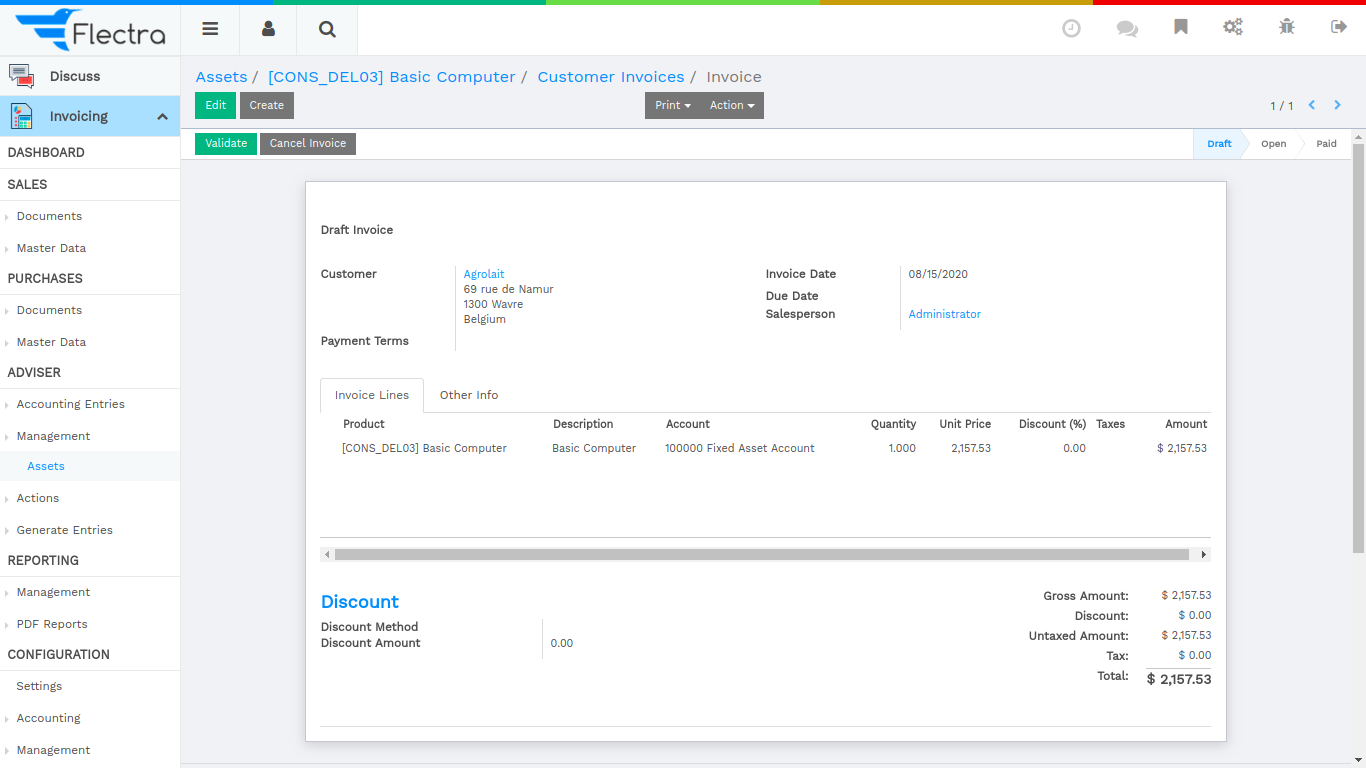

Customer Invoice details. If you created asset by Vendor Bills then it display Vendor Invoice button in asset form.

You can print report for Start Date to End Date.