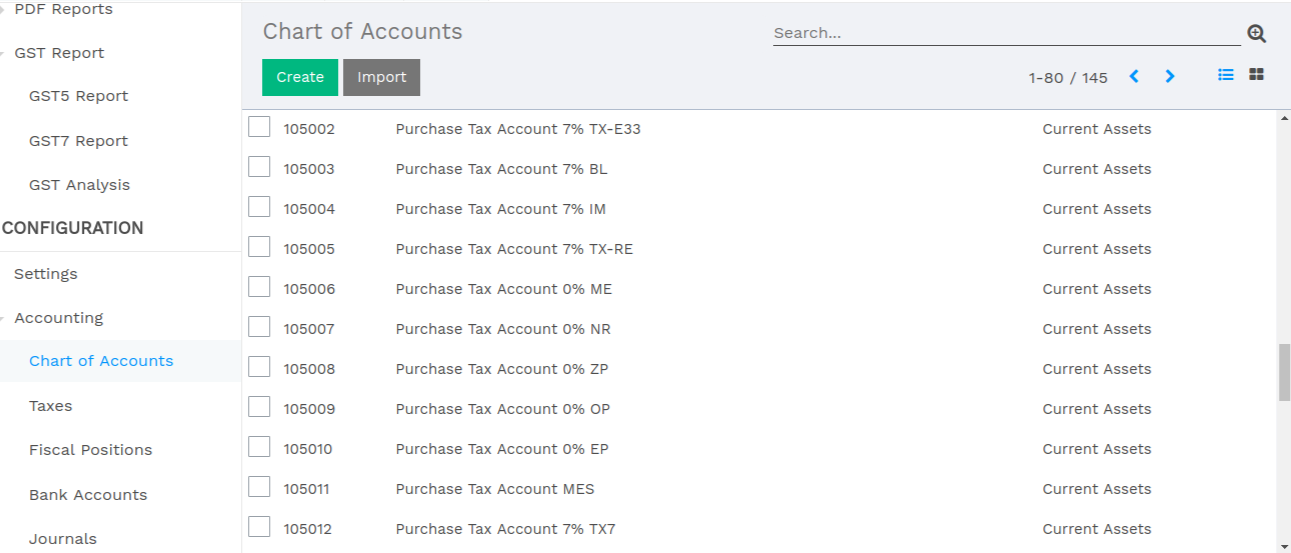

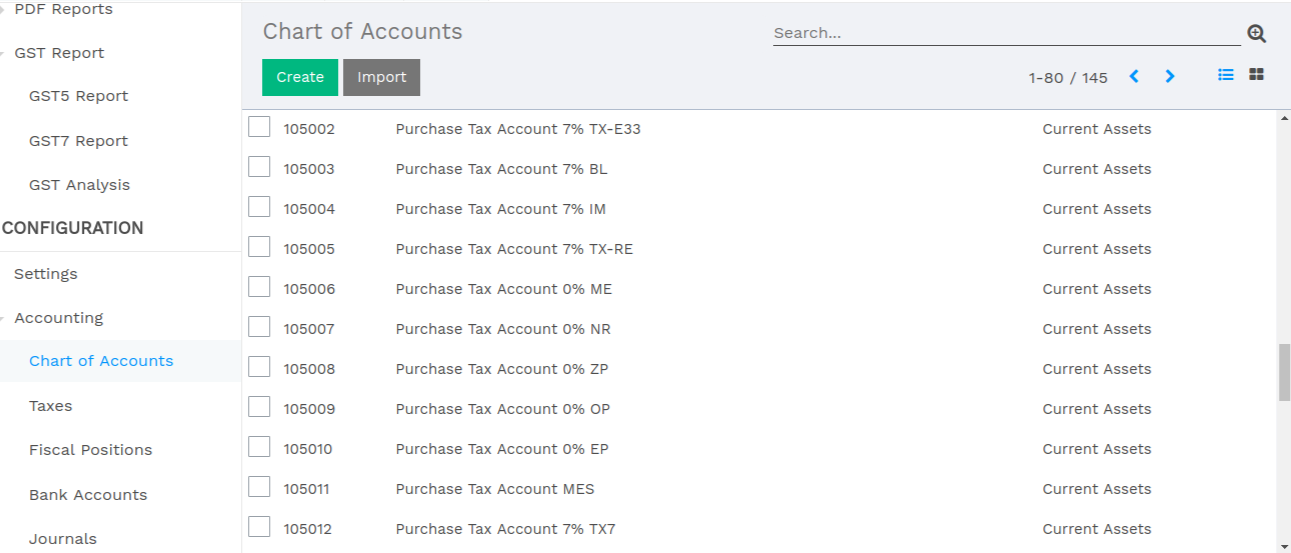

Chart of Accounts for GST Singapore

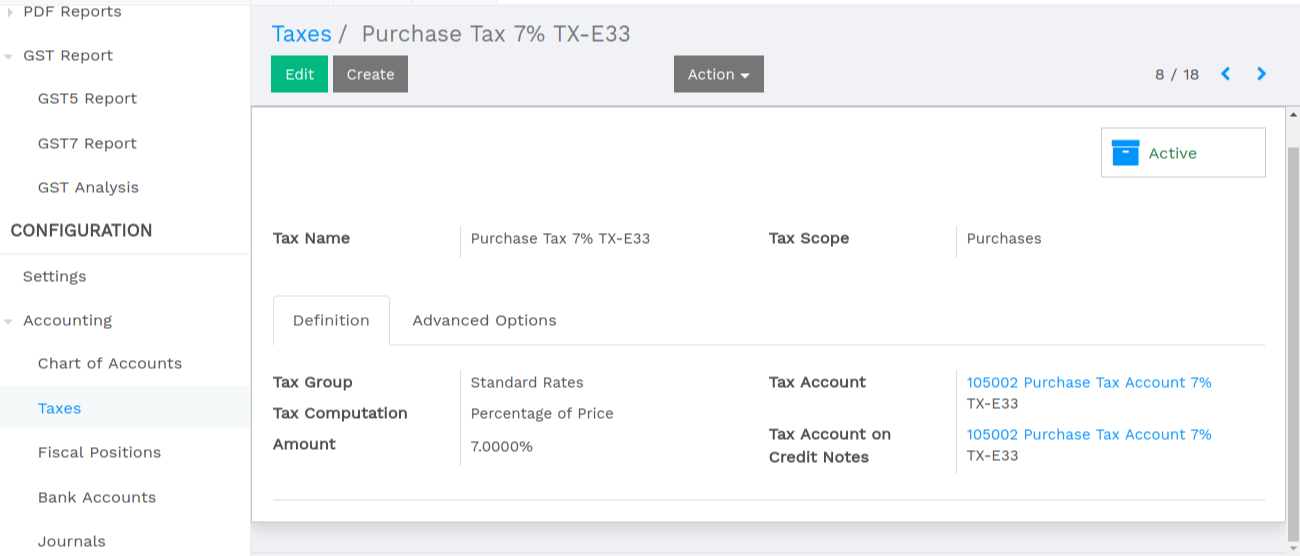

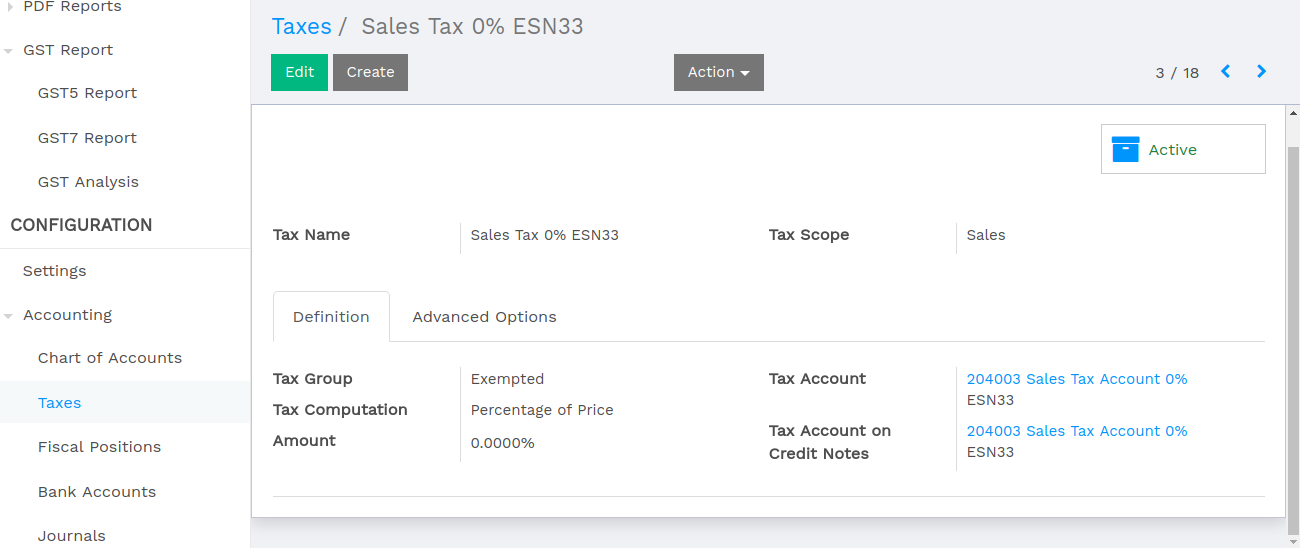

Tax Accounts configuration based on Singapore Accounting.

Tax Accounts configuration based on Singapore Accounting.

Categorize your tax codes into different categories.

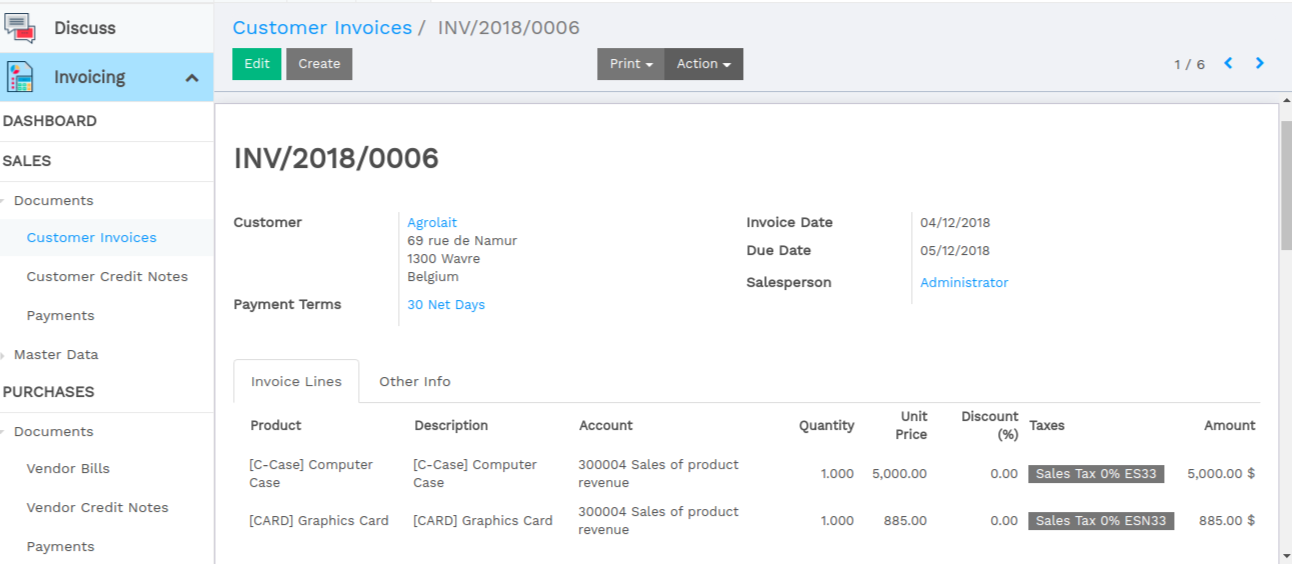

Customer Invoice with Taxes as per Singapore Localization.

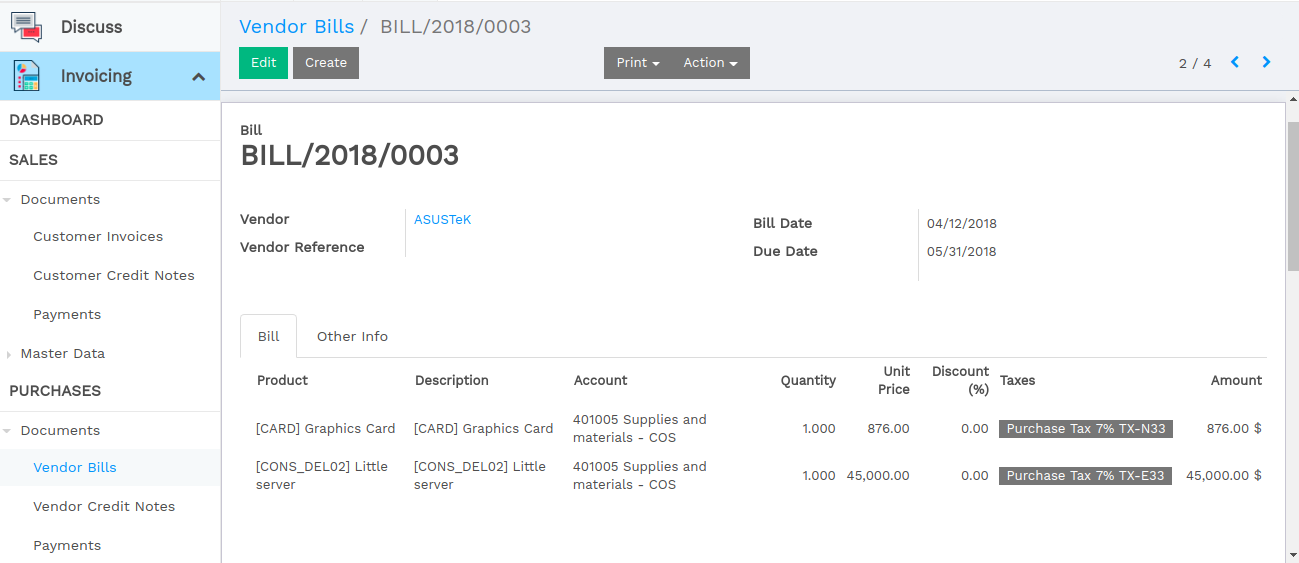

Supplier Invoice with Taxes as per Singapore Localization.

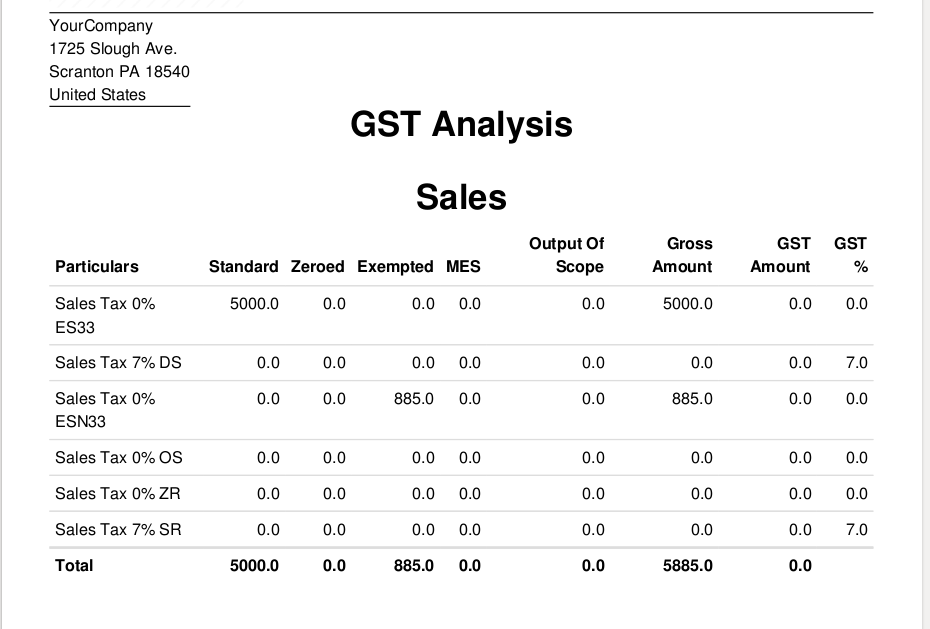

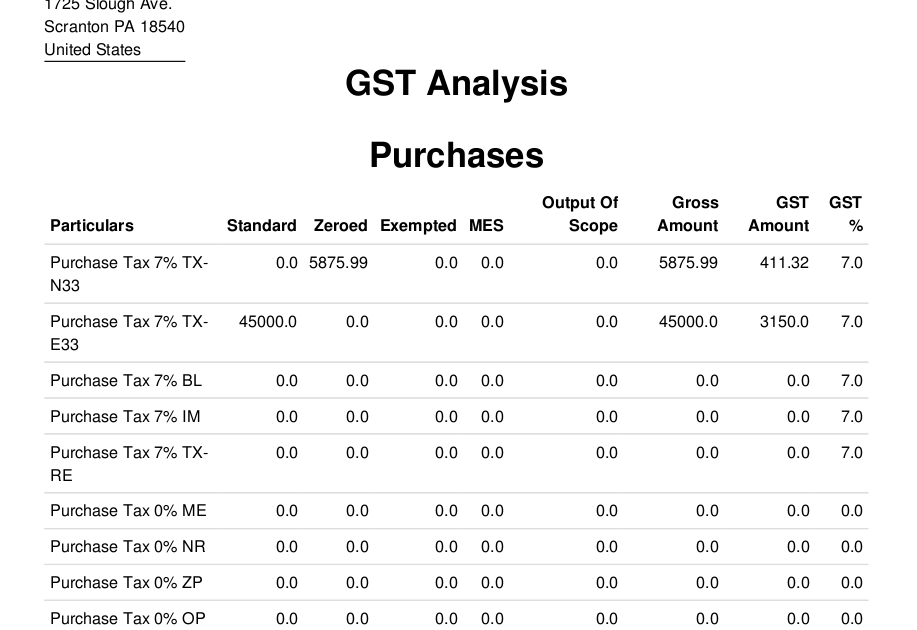

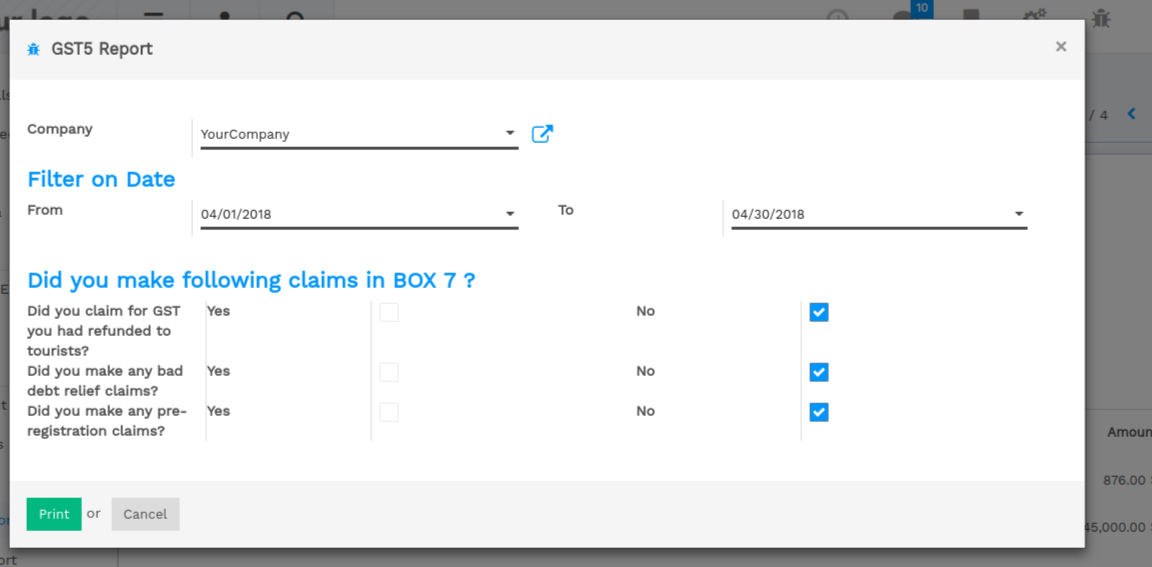

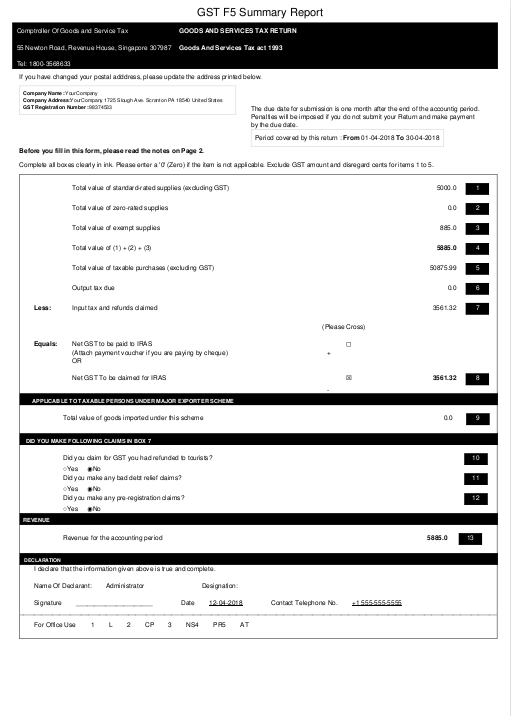

The GST-F5 report includes details such as standard-rated, zero-rated, and exempted, out of scope, mes, purchases and sales in a regulated format.

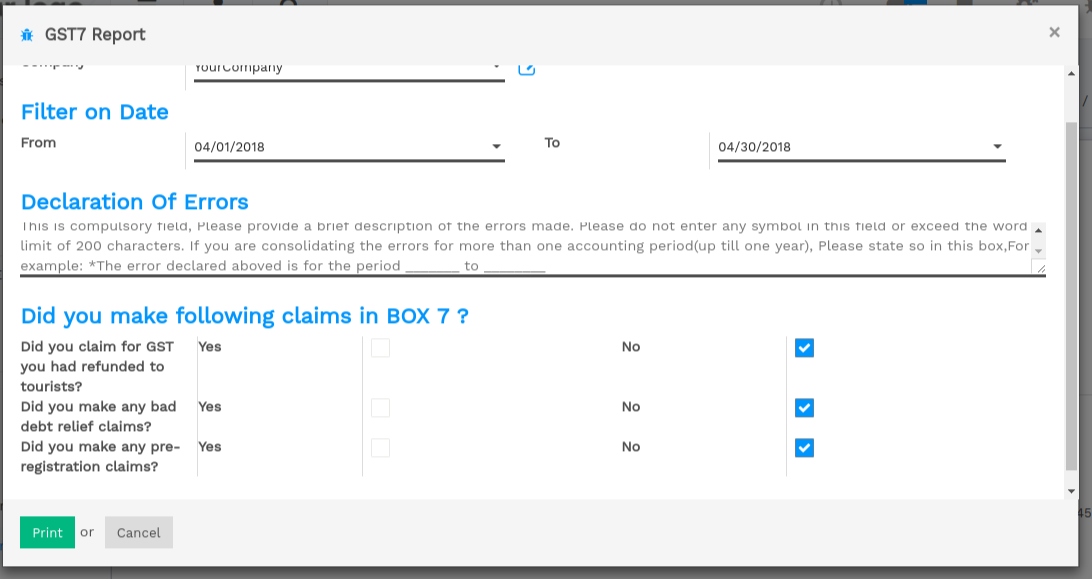

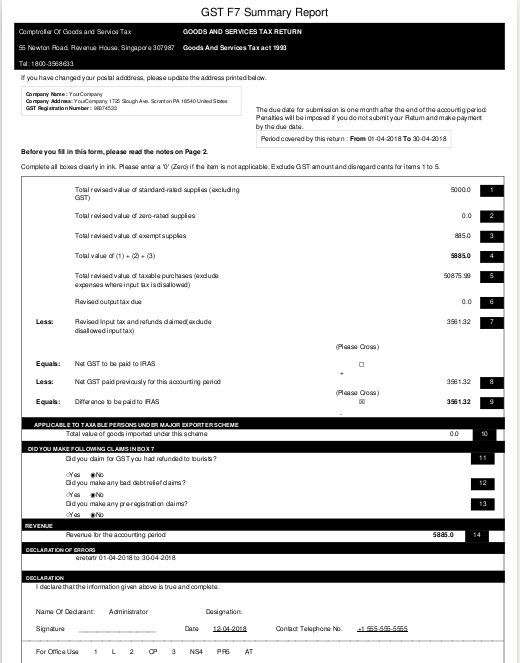

If you have made errors in your submitted GST F5 forms, you should file GST-F7 to correct the errors.